Home Loan Lender Fundamentals Explained

Table of Contents10 Easy Facts About Home Loan Calculator DescribedThings about Refinance Home LoanClark Finance Group Can Be Fun For AnyoneGetting My Clark Finance Group Mill Park To WorkWhat Does Home Loan Lender Mean?

Leisure lorry and watercraft finances Whether you're seeking a motor house or an electric motor boat, you may require assistance funding it. Personal finance lenders generally enable you to obtain for this objective.You might borrow as needed, however, up to your credit report limit. It's always an excellent suggestion to zero your credit rating card balance each month so that you do not pay the double-digit passion rates connected with Visa, American Express as well as other financial institutions.

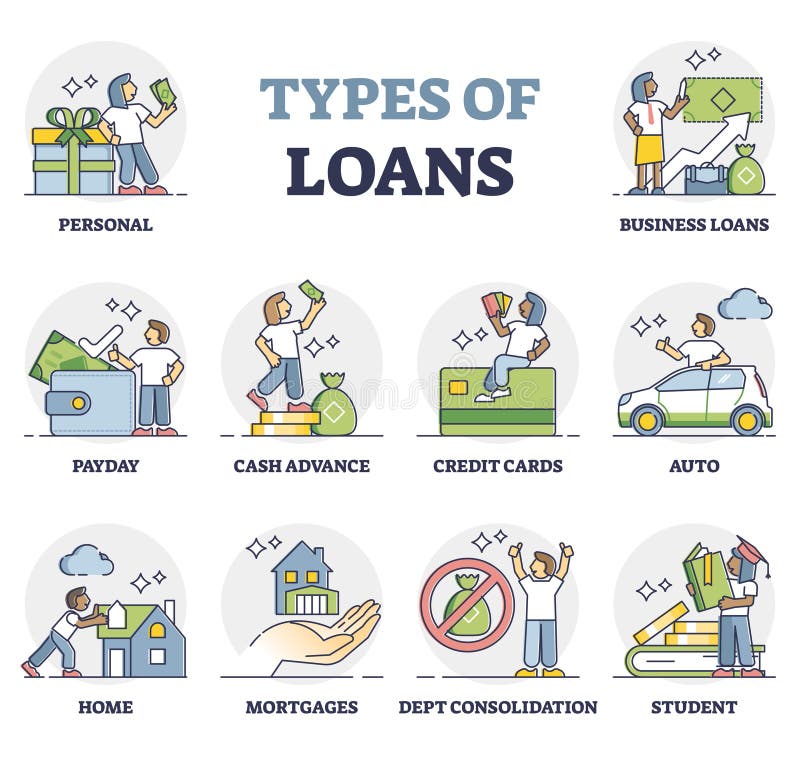

Line of credit also only charge rate of interest accurate you borrow, however early repayment is your finest alternative. What sort of lending should you obtain? Whether you're seeking to fund a "need" or a "desire," there are various sorts of financings. As well as although it may be noticeable to you what kind of lending to borrow, you could not be 100% certain concerning the details funding terms.

Clark Finance Group - Truths

Unprotected vs. protected fundings When it comes to the different kinds of loans, they all drop right into one of 2 classifications: unprotected and safeguarded. A protected finance does need collateral, such as your cars and truck or a financial savings account, and also its worth might impact exactly how much you're eligible to obtain.

The majority of kinds of finances come with fixed interest rates, yet the rate you get for either will be based on your credit report rating.

Getting My Clark Finance Group Home Loan Calculator To Work

Repaired rate of interest enable you to understand just how a lot the funding will certainly cost you in its whole as well as enable you to budget plan appropriately. Variable rate of interest fundings may save you money if rates of interest drop, however if they go up, they can wind up costing you more. While they do have ceilings to safeguard borrowers from huge enter the marketplace, those ceilings are usually established fairly high.

Conventional Fixed Rate Mortgages A mortgage in which the interest rate stays the exact same throughout the entire life of the car loan is a standard fixed rate home mortgage. These loans are one of the most preferred ones, representing over 75% of all mortgage. They generally can be found in terms of 30, 15, or 10 years, with the 30-year alternative being one of the most prominent.

The biggest benefit of having a fixed price is that the homeowner knows precisely when the rate of interest and principal payments will be for the length of the finance. This allows the house owner to budget less complicated because they understand that the rate of interest will certainly never transform throughout of the finance.

Mortgage Broker Can Be Fun For Everyone

The rate that is set in the beginning is the price that will certainly be charged for the whole life of the note. The property owner can budget since the monthly repayments continue to be the exact same throughout the whole length of the loan. When prices are high and also the house owner gets a set price home loan, the property online lenders owner is later able to refinance when the rates go down.

Some financial institutions wishing to maintain a good client account may swing closing expenses. If a buyer buys webpage when prices are reduced they keep that rate secured also if the wider rate of interest environment climbs. House buyers pay a costs for securing in certainty, as the passion rates of set rate loans are usually greater than on flexible price home fundings.

The Ultimate Guide To Clark Finance Group Refinance Home Loan

One of the greatest draws to this program is the reduced down-payment amount. The majority of down settlements are around 10% or higher. However, the FHA program provides down repayments for as reduced as 3. 5%. This means purchasers don't have to bother with saving as much for their deposits, and also they can conserve their cash for repair services of reserve.

Consumers can acquire a residence in any neighborhood navigate to this site located in the United States, the District of Columbia, or any type of area the United States holds. You can buy a single family members house, 2 system residences, three as well as 4 device residences, condominiums, mobile houses, as well as made houses. Every home-buyer does not have a social safety and security number.